Congress might be working on another round of COVID-19 economic relief payment (EIPs).

I say might because although the House in mid-May approved the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act and its provisions for even more stimulus money, the Senate and White House are dragging their heels.

Not quite the max: Democrats, in pushing HEROES through, argued that the $1,200 per person ($2,400 for married filing jointly couples) and $500 for each qualifying child was not enough

Some folks, however, didn’t even get that. They were issued less because, under the CARES Act rules, they made too much money.

The payments the Internal Revenue Service delivered — or, in some cases, is still delivering (people hope!) — were based on individuals’ 2019 or 2020 tax year data. If the applicable tax year information showed the taxpayers made more than a certain amount, shown in the box below, they got a reduced payment.

| CARES COVID EIP Income LimitsThe full $1,200 per person is available for individuals whose adjusted gross income (AGI) is up to:$75,000 for individuals with a filing status as single or married filing separately,$112,500 for head of household filers and$150,000 for married couples filing joint returns.The relief payments start to phase out when AGI is between:$75,000 and $99,000 for single or married filing separately taxpayers,112,500 and $136,500 for heads of households and$150,000 and $198,000 when a married couple filed jointly.When your AGI is more than the top phase-out amount for your filing status, you will not receive any COVID-19 payment. |

A chance to recoup the balance: The good news is that the COVID-19 EIP officially is a 2020 tax year credit. The prior filings were used simply to speed up the delivery of the stimulus money, rather than making us all wait until we file our 2020 tax returns next year.

That means there’s a possibility, depending on our incomes this year, that if we didn’t get the full amount, we can claim the balance when we do our taxes next year.

To make up the difference we didn’t get, however, we’ll need to show the EIP amount we did receive. And that brings us to this week’s Tax Form Tuesday.

Letter, notice, tomato, tomahto: When you got your EIP, either by direct deposit, paper U.S. Treasury check or debit card, you also should have received around the same time a letter on White House stationary.

That correspondence, which bears the signature of Donald J. Trump and a redacted copy of which is below, notes how much COVID-19 stimulus money you got.

That correspondence also is an official Internal Revenue Service document, Notice 1444, Your Economic Impact Payment.

Reminder to keep with tax records: The IRS recently alerted tax professionals via the agency’s regular weekly emailing to the group about the importance of that letter.

The title of the electronic message gets right to the point: Remind your clients to keep Notice 1444, Your Economic Impact Payment.

But now, after millions have received their stimulus money, it’s a tad late to tell taxpayers that the letter needs to go into their tax record files. Or at this point in time, it’s more likely that tax preparers will be asking their clients to try to locate Notice 1444, that is if the clients didn’t just toss it in the trash after it arrived.

I mean, who could blame folks. They were (are) just looking for the money itself.

The letter was (isn’t) negotiable currency.

And some (OK, many) who aren’t Trump fans or think the letter was (is) just a waste of paper, time and money to print it, just tossed it.

Plus, it didn’t even have an official looking IRS imprimatur or say, even as a postscript, “keep this document.”

Heck, you can’t even find a general version using the IRS tax document search tool. With a general website search, it just shows up as a mention in one of the special COVID tax tips, which is a version of the alert sent to tax preparers.

Reconciling EIP tax credit amounts: Maybe you kept your letter because you wanted some 45-related memorabilia.

Or maybe you’re like me. I held on to mine because (1) I’m a hoarder when it comes to tax documents and (2) I wanted to follow my own earlier blog advice. OK, you’re like me as far as the first reason

Back in late March when the Coronavirus Aid, Relief and Economic Security (CARES) Act became law, I noted in my first post (of many) about the COVID-19 relief package that:

As for the COVID-19 payments, you may have more or less money in 2020 or a larger or smaller family than you did in 2019 or 2018. Those changes will affect the amount of credit for which you’re eligible.

Either way, you’ll have to figure on your 2020 return the payment owed to you based on 2020 data. Then you’ll compare it to the advance payment you actually received and reconcile any differences when you file your taxes next year.

I also pondered the possibility of the IRS issuing a usual third-party form to help in this reconciliation:

So take note of the check amount you get. I suspect that like the Affordable Care Act’s Form 1095-A to use in reconciling advance Premium Tax Credit amounts, Uncle Sam will send out a form with the COVID-19 payment amount. But just in case, I’d save a digital or, if you’re old-school like me, also a paper copy of the credit amount.

No further EIP mailings: Well, it looks like my guess about a another EIP form isn’t going to pan out.

Based on the IRS’ June 19 electronic reminder to tax pros, the agency is simply going to rely on the White House letter that’s already been or will be sent to EIP recipients, rather than issue another piece of paper regarding the payments when we get into the 2021 tax season.

Let me join those tax professionals in getting out the word. Keep Notice 1444 as part of your tax records.

It’s written documentation of the advance credit you got. That will let you see when you file your 2020 tax return next year, how much additional credit you might be able to claim.

Tracking down your letter: If you didn’t (don’t) get your full EIP amount this year, I hope you can locate your letter.

At least try to find bank records or other documentation you can use to verify the balance for additional credit claims next year.

I also want to take this opportunity to say that while tax record keeping is critical, you — and by you, I mean me — can go to extremes. I refer you back to my tax document hoarder comment a bit earlier in this post.

I finally faced up to my tax paper collection addiction and earlier this month spent time clearing out years of old tax material.

Don’t be as acquisitive about tax material as I am. Keep the tax documents you need and for as long as you need, but no more.

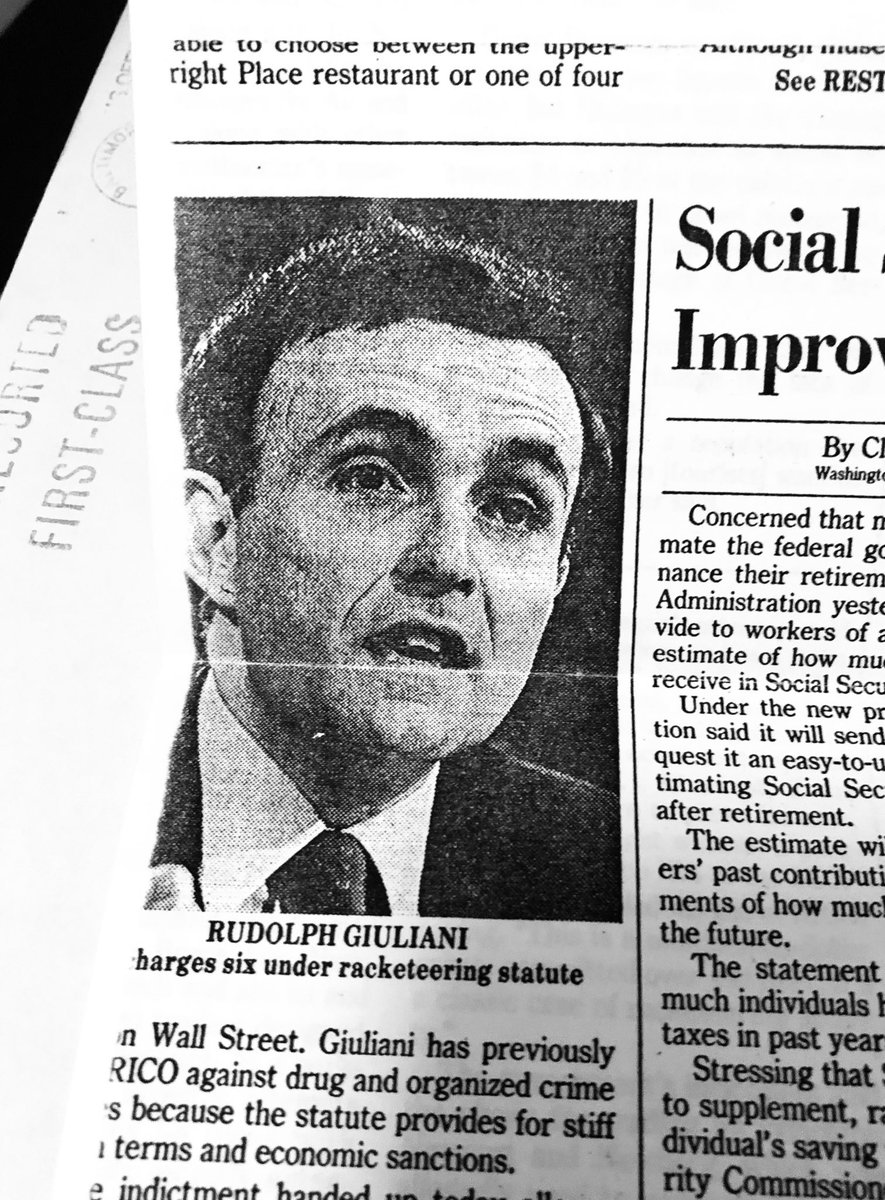

At least during the process I also ran across this Rudolph Giuliani gem:Kay Bell@taxtweet

OMG! Cleaning out old files & found this 1988 clip with Rudy’s photo. I actually had saved a WaPo article about upcoming Social Security changes but got head o’ hair Giuliani, too!

Recent Comments